☕️ ANNUS OPERUM ☙ Friday, January 30, 2026 ☙ C&C NEWS 🦠

Trump accounts and education credits transform American politics forever; Mamdani thwarted by immigration expenses; blue states double down; Republicans prep for litigation surge; Kennedy plan; more.

Good morning, C&C, it’s Friday! WHAM— just like that, January is almost over. One more chilly day and then we’ll enter February. I’m hotel-blogging from sunny St. Petersburg, where —believe it nor not— snow is forecast tomorrow for the first time since 1977. I’ll be speaking soon at Stetson University. So, in your rapid-fire roundup, delivered early: Trump kicks off his historic Trump Accounts plan with Trinidadian rapper, and forever changes American politics; a million signups; companies races to pile on; possibilities endless; children’s education tax credits kick in and progressives face a new political reality; Mayor Mamdani blames prior mayor for budget shortfall but is quickly given Pinnochios by social media; blue states rush toward irrelevance; Hochul vows to stop NYC’s tax hikes; states pile on taxing the rich; wealth management firms move to Florida; legislative surge looms; Lindsay Graham races to pass a bill dropping the hammer on sanctuary states; Republicans number bills to codify Trump executive orders; matching updated SAVE Acts filed in both House and Senate, suggesting Republicans envision quick action; and Secretary Kennedy confirms his plan to strangle Big Pharma without Congress.

🌍 ESSENTIAL NEWS AND COMMENTARY 🌍

🔥🔥🔥

Earlier this week, ABC ran a story with the unlikely headline, “Nicki Minaj helps Trump kick off Trump Accounts for children.” A series of dramatic announcements from American companies followed over the last few days. “The size and scale of this wealth will dwarf all government programs ever created to benefit America’s youth,” President Trump said at a press event. He’s not wrong.

In case you missed it, “Trump Accounts” were created in last year’s OBBBA. They are a new type of tax-deferred investment account for all Americans born after 2025 or those under 18. For newborns, the government will automatically create accounts and “seed” them with $1,000 to get things started. Families can add $5,000 per year, and employers can chip in $2,500 annually.

States, local governments, and nonprofits can also chip in— but with no annual limits.

This is going to be huge.

Any child (under 18) with a valid Social Security Number can open a Trump Account. Parents or guardians can open and manage accounts for their children. Check out TrumpAccounts.gov, where parents can enroll by filling out new IRS ‘Form 4547.’ (Hehe. Not a joke, as Joe would say.) Every parent should do it right now.

Contributions start on July 4, 2026— the same day as America’s 250th anniversary. The money must be invested in an index fund that tracks the broader stock market, and it can’t be withdrawn until age 18. Without any additions, the balance should grow to at least $50,000 by the age of majority. With even a little extra juice, the balances could become substantial. Hundreds of thousands of dollars. Maybe over a million by age 28.

For every American child.

🔥 At yesterday’s Cabinet meeting, Treasury Secretary Scott Bessent said over a million families have already signed up. In one week. Around twenty-five million families are eligible in all.

CLIP: Scott Bessent reports on Trump Account signups (0:56).

Trump announced the kickoff and strong corporate participation alongside Trinidadian rapper Nicki Minaj, who apparently became famous in the 2000’s for her often obscene urban music. What can I say? Tastes vary. Listening to Minaj’s odd cadence of speech is frequently like trying to listen to a scratched record played backwards. But President Trump is, after all, a man of the people.

Following the debut, a cascade of American companies immediately announced “employer match” programs for the accounts, including Charles Schwab, Robinhood, SoFi, Uber, Charter Communications, BNY, Intel, Nvidia, Steak-n-Shake, TPUSA, and Comcast. The list continued growing all week. Trump encouraged even more companies to join in. “I’m officially calling on all employers all across America to follow the lead of many of these amazing companies and make matching Trump Account contributions to benefit the American worker,” he said.

Some companies even offered universal donations. JPMorgan Chase said it would match the government’s $1,000 contribution for all qualifying infants. Michael and Susan Dell announced they’d deposit $250 for every child aged 10 and under who lives in a ZIP code where the median income is below $150,000.

If you think all this corporate participation happened by accident, then I have some waterfront property in the Everglades to sell you. Obviously, Trump did it. We’ve never seen a President like this. He should be a progressive darling. Liberals ought to love him.

Through encouragement alone, he’s transferring wealth from rich corporations and well-heeled donors to poor American babies. But he’s also simultaneously satisfying conservatives— because the program is voluntary, and it is based on market principles, like private ownership and personal responsibility. It’s genius.

This plan, alone, is likely to transform American politics in ways that are difficult to comprehend, much less predict.

What big issue will Democrats have left to cry about, when American children —black, white, poor, and rich— are all financially cared for? What happens to the Democrats’ amorphous “affordability” argument that children won’t be better off than their parents? What about their relentless for the children mantra? Trump just fixed all that in one fell swoop.

This could produce a once-in-a-century shift in the social contract. It might be even bigger than FDR. It will pervade American politics. States and local governments will face tremendous pressure to join in … for the children.

“Decades from now, I believe the Trump accounts will be remembered as one of the most transformative policy innovations of all time,” the President said. He could very well be right. The historic nature of this program can’t possibly be underestimated. One can even conceive how the program could ultimately replace the failing Social Security catastrophe. It can be compared to a sovereign wealth fund for all Americans going forward.

But that wasn’t nearly all.

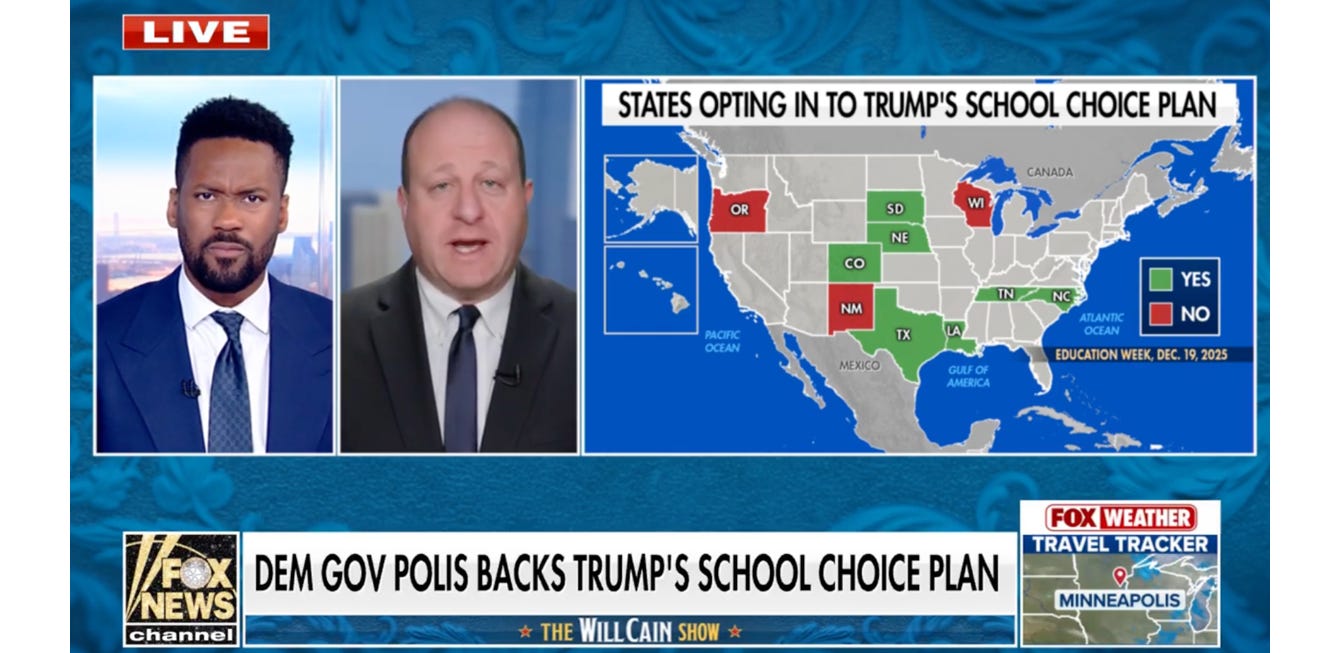

🔥 Two days ago, ChalkBeat (an education industry rag) ran a terrific and widely covered story headlined, “Pressure mounts on Democratic governors as more states opt into school choice tax credit.”

Under another OBBBA innovation, a new federal school choice tax credit program, individuals and businesses can directly reduce their own federal income taxes dollar-for-dollar, by donating up to $1,700 to nonprofit scholarship groups. These groups will, in turn, give lower and middle-income families scholarship money, to help pay for K–12 education expenses like private school tuition, tutoring, or extra services, on top of whatever public schools already offer.

This new program stacks on top of state-level voucher programs, which are also blooming across the country. It gives parents choice in getting their kids out of failing public schools, and also more options for creative educational opportunities; it’s a kind of like an educational savings account.

The main opponents have, unsurprisingly, been teachers’ unions, which you would think would be happy about it. After all, it will probably spur massive increases in private school options, which benefits teachers, too. What a joyless bunch.

🔥 At least 23 states, almost all red ones, have officially opted into the program, according to a tally from the Education and Treasury departments released Tuesday. So far, two blue states have signaled they intend to opt-in, Colorado and North Carolina (well, it’s blue-ish). Chalkbeat reported that the “other Democratic governors are facing pressure.” I bet they are.

Colorado Governor Jared Polis became the first Democrat to opt into the program in December, telling local media he “would be crazy not to,” while explaining that “it’ll empower more parents to be able to afford that after-school program or the summer program that they want for their kid.”

Once again, Trump found a third way. This program should also be catnip for liberals, since it drives money to “poor” families. It also pleases conservatives, because it hews to parental choice, expands private and homeschooling options, and is rooted in free markets.

The two programs combined form an end-to-end childhood security policy. If Trump Accounts scale as promised, and the school-choice tax‑credit program matures, kids could enjoy both subsidized or privately funded school options K–12, plus a sizable asset by age 18.

Suddenly and unexpectedly, the country confronts a radically different baseline than progressives’ “struggling, debt‑laden” narrative.

True, it doesn’t erase all inequality, but it does squash the simple narrative that “kids will inevitably be poorer than their parents,” and forces progressives to grapple with a world where a Republican president built both an ownership stake and a choice infrastructure for children.

🔥🔥🔥

Dear New Yorkers: as you know, elections have consequences. But hot air is also one of the potential options. Earlier this week, the New York Times reported, “NYC Mayor Zohran Mamdani calls for tax hike on richest residents, corporations to fix massive $12B budget deficit.”

The Big Apple’s youngest Mayor, in a world-class imitation of a broken record, is stretching liberal stereotypes to the breaking point. “The time has come,” Zohran Mamdani, 33, said, “to tax the richest New Yorkers and most profitable corporations.” The mayor said he never frets about any exodus of the City’s high earners or businesses if there is a tax increase. What, me worry? Mamdani is more concerned about working-class residents leaving because of the high cost of living.

If only he had more taxpayer money to play with! Then, life in the City that Never Sleeps will surely become more affordable. You believe that, right?

🔥 The 5’6” Mayor has stumbled, right out of the gate, over his first construction detour. It takes the form of a $12 billion budget in the City’s $112 billion annual budget. Applying lessons from Politics 101, in what CBS colorfully called “a blaming spree,” Mamdani mostly blamed his predecessor, former Mayor Eric Adams.

“This crisis has a name and a chief architect. In the words of the Jackson 5, it’s as easy as ABC. This is the Adams budget crisis,” Mamdani gushed. “He systematically under-budgeted services that New Yorkers rely on every single day.”

But Mayor Adams wasn’t taking that lying down. He quickly shot back on social media, pointing out that, in 2023, he was ringing alarm bells predicting exactly this outcome. Unfortunately for Mayor Mamdani, the Adams story was widely reported at the time. Headline from Politico, August 2023:

“If we don’t get the support we need, New Yorkers could be left with a $12 billion bill,” Adams said at the time, in a formal address from City Hall. “The immigration system in this nation is broken; it has been broken for decades,” Adams added, declaring: “Today, New York City has been left to pick up the pieces.”

Ruh-roh, Scooby! One of the biggest planks in Mamdani’s policy portfolio is sanctuary status, deleting ICE, and promoting rights of illegal aliens to vote in city elections. The debate exhausts him. “I’m exhausted from waking up each day to news of someone being forcibly removed from their vehicle, their home, or their life. What we need is a sense of humanity,” Mamdani said in a very non-exhausted way just ten days ago.

“I am in support of abolishing ICE,” he added, warming to his theme, “because it’s terrorizing people no matter their immigration status, no matter the facts of the law, no matter the facts of the case.”

Any good Marxist can see that hiking taxes on “rich people” is the obvious answer.

The article explained the collectivist Mayor has two signature policy plans: first, raising the corporate tax rate to 11.5%, and then slapping a 2% city income tax on people earning $1 million or more. Trouble is, he lacks the authority to hike those tax rates, which are powers reserved to Albany.

What Mamdani could do is raise property taxes — the City’s single largest revenue source — but he’s been notably silent on that, which would be the only tax option he could actually deliver on.

Which leads to the little Mayor’s second problem.

🔥 At an unrelated event Wednesday, New York Governor Kathy Hochul nixed any new income taxes. Reporters asked her whether she’d work with Mayor Mamdani to achieve his goal. She said no. “The news flash, maybe you haven’t heard me, is we’re not raising taxes in the state of New York,” she vowed. “So he’ll continue to say what he needs to say, I’ll continue to say what I want to say, and you can report it any way you want.”

Which was mildly strange, because as recently as November, Kathy had said the exact opposite. Reuters, November 14th:

Hey, a gal can change her mind. The article noted that the state has its own $32 billion budget shortfall, and said “the deficit, when coupled with recent federal actions, reached levels not seen since the 2009 economic crisis.” Ouch.

Hochul’s 2026 budget, released this month, included no new taxes. So if you live in New York, you dodged the bullet this year. But progressive politics often requires pivoting. New Yorkers should not count on Hochul’s position sticking.

🔥 While the schadenfreude over Mamdani’s struggles tastes great, there’s a bigger pattern in play. In the wake of Trump’s cuts to blue-state federal aid, several big blue states are practically sprinting to make up the difference by “taxing the rich.”

In California, progressive groups have either qualified, or are close to qualifying, a 2026 “Billionaire Tax Act” ballot measure to impose a “one‑time” 5% excise tax on individuals and trusts with a net worth of at least $1 billion, covering “all forms of personal property and wealth.” Separate initiatives focus on a recurring wealth, and a general high-earner tax for health care funding, spurring organized opposition from the tech billionaires.

Last year, Maryland boosted income tax rates on residents earning more than $500,000, explicitly framed as a way to narrow that state’s budget deficit.

In Connecticut, Democrat lawmakers are musing increased income tax rates on “rich people” earning $250,000 or more (or $500,000 for couples) to offset the expected federal funding cuts. The bills are under heated debate, but have not yet passed.

In Washington State, after adopting a capital‑gains tax last year, Governor Bob Ferguson (D) now supports a new “millionaire’s tax” of 9.9% on annual income above $1 million, with final details expected in the 2026 legislative session.

Rhode Island recently passed a new levy on vacation homes valued at $1 million or more, popularly dubbed the “Taylor Swift tax,” aimed at raising revenue from luxury property owners and ‘nudging’ second homes back into the general housing market.

Tax the rich! The problem with this scheme, of course, is that rich people can move. The wealthy are the most mobile of all. They might not like moving —who does?— but they can do it more easily. So I found this next quiet headline instructive. Palm Beach Post, ten days ago:

Wells Fargo is a San Francisco-based company. Years ago, it located its “wealth management” division —the bank’s group focusing on high-net-worth individuals— in New York. This month, the division abruptly relocated to South Florida. The group explained that the move would position the firm’s leadership closer to its “most significant clients” amidst a fast‑growing South Florida wealth hub.

Florida has no personal income tax. Its corporate tax is one of the most limited in the country, and offers the most exemptions; for instance, S-corporations and LLCs are completely exempt.

Over the last few years, South Florida’s millionaire population has doubled, as the region acquired the exciting title of “Wall Street South.” Presumably, these new millionaires didn’t just airboat in from the swamps or appear from thin air. They came from somewhere.

🔥🔥🔥

If last year was Trump’s Year of Preparation, 2026 is the Year of Action. Or, in Latin: the Annus Operum. Last year, Congress displayed the keen organization and leadership of a group of confused Chinese tourists who accidentally got off their bus in Live Oak instead of Orlando.

But this week delivered increasing signs that Congress is, in fact, preparing a ‘surge’ of welcome legislation— as Speaker Johnson had promised.

First, on Tuesday, the Wall Street Journal ran a story headlined, “Sen. Graham Proposes Bill Ending Sanctuary Cities.” Senator Graham is seeking a vote on the terrific bill this week. That’s fast.

This week, Senator Lindsey Graham (R-SC) introduced a bold new bill to finally shut down sanctuary states and cities for good. Such policies, adopted in about a dozen blue states and goofy progressive cities, limit cooperation with federal immigration enforcement— refusing to honor ICE detainers, cooperate with arrests, or share information about criminal suspects who may be in the country illegally.

Graham’s bill would impose criminal penalties against any state and local officials who willfully obstruct federal immigration laws, aiming to eliminate what he calls a major source of chaos, fraud, and threats to public safety. Not civil penalties; criminal charges.

Graham explained in a recent appearance, “You can never have law and order with sanctuary city policies.”

The bill, developed in close coordination with the Trump administration, seeks to enforce nationwide accountability and restore the basic rule of law on immigration. (Graham’s bill is going nowhere unless they do something about the silent filibuster. Just saying.)

It’s worth noting that in 2019 and 2023, Florida passed strong laws banning ‘sanctuary cities’ in the Sunshine State. Over the same period of time, Republican registrations surged past Democrats. Coincidentally?

Could the Minneapolis riots be making bills like Graham’s politically possible?

🔥 Next, we now have a number —and it’s a big one— on how many bills Republicans in the House have planned. CLIP: Anna Paulina Luna (R-FL) said Speaker Johnson has agreed to ‘codify’ a record number of Trump executive orders (1:30).

“We need voters to show up to the polls,” Luna correctly noted. “Upon returning from break,” she continued, “Speaker Johnson has announced there’s going to be 81 of those Trump executive orders we’ll be codifying, so they can never be changed.”

If they do it —and it seems increasingly likely they’ll try— codifying the Trump executive orders will energize the base and will convince voters to show up to the polls.

Even more intriguingly, Ms. Luna also added that, “One of the top issues right now is banning insider trading — we will be doing that within the first quarter of this year.” That would surely energize voters, and drastically change politicians’ incentives on Capitol Hill.

🔥 Third, yesterday —as promised— Senator Mike Lee (R-La.) and Rep. Chip Roy (R-Tx.) reintroduced the pending election integrity bill, now renamed as the “SAVE America Act.” The key is that the House and Senate bills now match, paving the way for passage.

One day after Senate Majority Leader John Thune announced he would support the bill, Senator Lee and Representative Roy simultaneously reintroduced overhauled versions of the SAVE Act (Safeguard American Voter Eligibility Act), now called the SAVE America Act. This key legislation aims at bolstering election integrity by requiring in-person documentary proof of U.S. citizenship —such as a passport or REAL ID-compliant birth certificate— when registering to vote and voting in federal elections.

This would effectively end mail-in, online, or third-party (think DMV) voter registration, absent an in-person visit to election offices to complete the citizenship documentation step. Democrats complain it will “gut voter registration by mail and online.” Good.

The bill, which Lee sponsored in the Senate as the companion to Rep. Roy’s House version, would also require states to remove non-citizens from voter rolls and impose penalties on officials who register ineligible voters, thereby closing dangerous loopholes that could allow foreign interference.

Senator Lee emphasized the urgency, saying, “Illegal immigrants and non-citizens across the nation are being improperly registered to vote, allowing them to cast illegitimate ballots in federal elections... allowing the people of other nations access to our elections is a grave blow to our security and self-governance.”

There is still time to pass it before the midterms. I can’t believe I’m saying this, but it looks like they are actually preparing to try. The aligned House and Senate versions are a strong signal; if committees can avoid amendments, it could sail through and reach the President’s desk by late spring or early summer.

Democrats have promised to fight the SAVE America Act tooth and nail, meaning the silent filibuster remains a major problem.

This week brought more congressional activity from Republicans than we’ve seen since they passed the One Big Beautiful Bill Act early last summer. The surge might be coming. Annus Operum.

🔥 Finally, in yesterday’s Cabinet meeting, Secretary Kennedy reported to President Trump that over one hundred studies on the causes of autism are now underway.

I’m short on time, so you’ll have to watch this next exciting clip to get the full gist. In an interview with Jordan Peterson last year, Kennedy explained the “100 studies” strategy.

“I’ve been thinking about this for the last forty years, and I’ve figured out how to do it without Congress,” Kennedy explained. “To do it all with executive orders and policy changes.”

It’s death by a thousand cuts. Kennedy’s strategy for tackling America’s chronic disease epidemic centers on a deliberate, evidence-driven approach to shift federal research priorities and build overwhelming scientific consensus. Then let lawyers do the rest.

Rather than relying on a handful of studies that could be dismissed or marginalized, RFK Jr. is redirecting the NIH’s roughly $50 billion annual budget —historically skewed toward developing patented pharmaceutical treatments under the Bayh-Dole Act’s royalty incentives— toward independent research that identifies root environmental, dietary, and toxic causes of conditions like autism, obesity, and autoimmune disorders.

Specifically, he said that by commissioning a critical mass of around 100 rigorous studies, he can overcome the “Daubert standard” threshold used in federal courts for admissible expert evidence— by creating an irrefutable body of peer-reviewed science strong enough to withstand scrutiny and enable large-scale litigation against responsible industries. He compared it to his successful campaign against Monsanto over Roundup, where roughly 20 studies eventually supported billions in settlements and regulatory changes.

In other words, he intends to hand lawyers the evidence they need to bring Big Pharma to heel.

This multi-year lawfare plan, executed “one tiny step at a time” without needing congressional approval, was explicitly echoed in his seemingly offhand Cabinet meeting announcement this week, when he said that over 100 such studies on autism and related chronic illnesses have already been commissioned.

In other words, the Kennedy plan is well underway. It’s always been about the studies. Everything else —like canceling mRNA contracts and fiddling with the childhood vaccine schedule— now just seems like distracting noise providing cover for the real operation. The fact that Kennedy is now willing to publicly discuss it suggests he’s well on the way— otherwise he’d keep it under the radar to stymie Democrats.

It’s happening. Be optimistic.

Have a fabulous Friday! Ice skate back here tomorrow morning, for a whole new installment of Coffee & Covid’s nutritious essential news and commentary.

Don’t race off! We cannot do it alone. Consider joining up with C&C to help move the nation’s needle and change minds. I could sure use your help getting the truth out and spreading optimism and hope, if you can: ☕ Learn How to Get Involved 🦠

How to Donate to Coffee & Covid

Twitter: jchilders98.

Truth Social: jchilders98.

MeWe: mewe.com/i/coffee_and_covid.

Telegram: t.me/coffeecovidnews

C&C Swag! www.shopcoffeeandcovid.com

I was reading on X last night that a bunch of liberals are saying they won’t get a Trump Account for their kid because it had Trump’s name on it. Can you imagine the conversation when those kids go off to college or get started in their adult lives and most of their peers have a nice nest egg to get started with and they have nothing because their parents had TDS?

First Trump shut off the "NGO to democrats" funding pipeline.

Then Trump shut off the "federal safety net programs to democrats" funding pipeline.

Now he may shut off the insider trading grift?

How are dems going to make a living?