☕️ TRUMP SNEEZED ☙ Monday, April 7, 2025 ☙ C&C NEWS 🦠

Global crash, Trump tariffs bite; 25% of Earth seeks deals; China reels, EU buckles; UK flips; inflation, oil down; Main Street cheers; was a market reset the plan all along? And much more.

Good morning, C&C, it’s Monday! The news continues to be dominated by Trump’s tariffs and the world’s market response. So let’s dig in. In today’s roundup: global markets plunge as Trump tariffs take hold, but what’s the upside?; a quarter of the entire Earth lines up to do deals; China reels under tariff chaos; Europe in focus as Trump vows the EU will have to pay “a lot” in restitutionary back-invoices; British pivot to Trump agenda in astonishing reversal as tariffs begin to grip; Brussels Tower of Babel leans over; US inflation at rock bottom; oil prices plummet; Main Street celebrates; and the astonishing possibility that a stock market reset might have been the plan all along.

🌍 WORLD NEWS AND COMMENTARY 🌍

🔥🔥🔥

When America sneezes, the world goes on the ventilator. The Wall Street Journal ran the tariff-fallout story this morning, dramatically headlined, “Stock Market Today: Dow Futures, Asian Stocks Plunge as Trump Tariff Turmoil Deepens.” Our stock market is down, a good bit, but the foreign markets are crashing.

Mangling three different metaphors, the Journal reported that “turmoil in global markets snowballed into one of the worst routs in recent memory after President Trump said he will stay the course with aggressive, economically disruptive tariffs.” Indeed he did. However, the President stuck with a single, consistent metaphor, saying last night that “I don’t want anything to go down, but sometimes you have to take medicine to fix something.”

(It might have been rhetorically stronger to say sometimes you have to take medicine to cure cancer, or mental illness, but I can overlook it. Unlike the Journal’s overpaid writers, the President spoke off the cuff to hostile reporters. And there might be a very good reason he picked the word “something.” We’ll get to that.)

He continued, “China right now is taking a big hit. They have to pay tariffs.” Trump told reporters he spent the weekend speaking to tech executives, including “four or five that are considered the biggest” as well as other global leaders. “I spoke to a lot of Europeans, Asians, all over the world. They’re dying to make a deal,” he said.

“We’ve got 50 countries that are burning the phone lines into the White House up,” Agriculture Secretary Brooke Rollins said on CNN yesterday. Kevin Hassett, director of the National Economic Council, told ABC yesterday that more than 50 world leaders have so far reached out to Trump’s team to start negotiating.

Think of that. Fifty countries is more than 25% of the entire world.

Trump is holding massive leverage. Global markets are getting beaten worse than a micro wrestler in a bar fight. Mainland China's CSI 300 index dropped sharply into a plunge of around -6% to -7%. Hong Kong's main stock measure, the Hang Seng Index, crashed -13%— its worst day since a 1997 landslide during the Asian financial crisis. Indexes in Shanghai, Taipei and Tokyo fell between -7% and -10%. European markets have free-fallen between -5% and -7% since their openings early this morning.

In an interview on NBC’s Meet the Depressed, Treasury Secretary Scott Bessent said, “I can tell you that, as only he can do at this moment, President Trump has created maximum leverage for himself. And more than 50 countries have approached the administration about lowering their non-tariff trade barriers, lowering their tariffs, and stopping currency manipulation.”

Bessent echoed our C&C analysis. “Who knows how the market is going to react in a day, in a week? What we are looking at is building the long-term economic fundamentals for prosperity,” he told NBC.

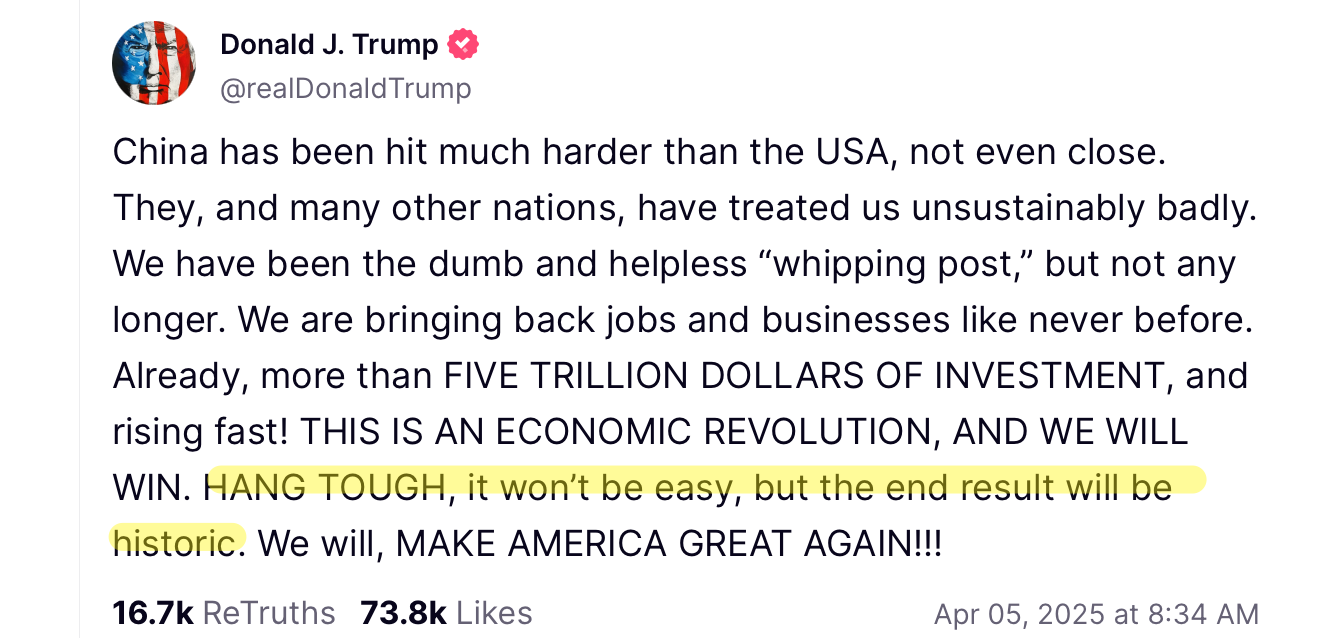

On Saturday, President Trump encouraged Americans to hang tough while we fight through a bold adjustment that no president has ever before been courageous enough to dare:

China is reeling. The New York Times ran a story this morning headlined, “China Tries to Downplay the Trade War’s Effects on Its Economy.” The Great Dragon is bracing for impact. “The abuse of tariffs by the United States will have an impact on China, but ‘the sky will not fall,’” an official Chinese commentary bravely tried to reassure citizens on Sunday. “China is a super economy. We are strong and resilient in the face of the U.S. tariff bullying.”

The world leaders aren’t calling Trump’s economic haggling team. They’re calling his hostage negotiating hotline.

💰 Europe is on particularly shaky ground. EU Ministers will hold yet another emergency meeting today in Luxembourg to discuss how to collectively respond to U.S. tariffs. Meanwhile, Trump is dickering separately with many individual EU leaders.

Some commenters already speculate that Trump’s tariffs could shatter the European Union.

The European Union is a patchwork of competing national interests duct-taped together by bureaucracy and inertia. Trump is exploiting a structural weakness: the EU speaks with one voice— unless a member state sees a better deal. And the President can offer them better individual deals. You might call it a “tariff scalpel” strategy— slicing not just into trade surpluses, but also slicing apart alliances.

Only a couple weeks ago, the Europeans held frantic emergency meetings to discuss how to undermine America’s peace negotiations with Ukraine and Russia. Now they’re hanging on for dear life. They’re scrambling to keep their economies afloat and to stop them from unraveling under the weight of U.S. tariffs and retaliatory market chaos.

Thus we begin to see even more outlines emerging of the bigger play. It’s not just economic leverage. It’s strategic sequencing: destabilize, divide, deal. In his AF1 comments last night, Trump had harsh words for the meddlesome Europeans.

CLIP: Trump vows Europe will have to pay up (0:19).

“Europe’s treated us very badly,” the President explained. So “we put a big tariff on Europe. They’re coming to the table; they want to talk.” But, he said, “there’s no talk unless they pay us a lot of money on a yearly basis, number one for present but also for past. Because they’ve taken a lot of our wealth away. And we’re not gonna allow that to happen.”

For Europe, therefore, it’s not just equalization— it’s retaliation. It’s reparations. I bet now they wish they hadn’t so enthusiastically leapt into the elections interference game back in 2020. They tried to sabotage his presidency. Now he’s dismantling their union— one tariff at a time.

💰 The Trump strategy is already beginning to grip. Yesterday, the Times of London ran this astonishing headline: “Keir Starmer to admit globalization has failed as tariff war rages.” Three weeks ago, UK Prime Minister Starmer sat in the Oval Office with his snobbish delegation to deliver a prim, polite threat on behalf of Ukraine’s penis pianist. (If you’ve been reading closely, you’ll recall how the Epstein-binder fracas blew the Brits out of the water.)

According to the Times, Starmer is set to deliver a major speech today in which —get this— he will “declare an end to globalization and admit that it has failed millions of voters.” There was more. Starmer “will also say he understands Trump’s economic nationalism, and why it is popular with voters who believe they have seen no benefits from free trade and mass immigration.”

An unidentified Downing Street official added, “Trump has done something that we don’t agree with but there’s a reason why people are behind him on this. The world has changed, globalization is over and we are now in a new era.”

To say that London is the world’s globalization headquarters is like saying the Mouse lives at Disney World. London has been the velvet-gloved epicenter of globalism ever since the East India Company shipped spices and opium on the same manifest. London’s financial class didn’t just benefit from globalization— they practically wrote the instruction manual. For them to start hand-wringing now about “mass immigration” and “no benefits from free trade” is a sign the ground is shaking beneath the WEF cathedral.

Trump isn’t just Making America Great Again. He’s also making Europe great again, freeing it against its will from its smothering Babylonian bureaucracy in Brussels. In short, Trump is jackhammering a wedge between European national identity and EU hegemonic bureaucracy— between real nations and their synthetic supranational babysitters. It’s starting to look like Brexit on steroids.

Originally meant to accelerate freedom, the EU instead metastasized into a kind of marxist Babel, where its 27 nations whisper away their sovereignty into a miasmic muddle of policy fog drafted by unelected clerks fluent in cloistered crypto-languages of arcane acronyms and elliptical euphemisms. Now, the Tower of Babel in Brussels is teetering over worse than the Leaning Tower of Pisa.

The Times ended its story by morbidly reflecting that President Trump once “said the European Union was created to ‘screw’ the US.”

💰 Meanwhile, according to Truflation, the US inflation rate is scraping the bottom:

So much for the experts and their gloomy predictions of spiking prices. Trump’s tariffs and the market shockwaves aren’t triggering inflation— so far, they’re triggering a whole new paradigm.

On Friday, Forbes ran a story headlined, “Oil Prices Drop 7% To Four-Year Low As Tariff Fallout Sparks Recession Fears.” In other words, pre-Biden oil prices are somehow bad news. Only to Forbes, though. Since oil prices affect the cost of everything, plunging fuel prices predict still lower grocery store bills.

Wall Street is crying— but Main Street is dancing.

This is quickly exposing one of the great hypocrisies of the age: the Democrats, long self-branded the “people’s party,” are the ones most hysterical about the stock market. Just as the pandemic revealed their indifference to actual working people, today’s Wall Street freakouts expose where their real loyalties lie.

For 80% of Americans, ‘stock portfolios’ consist of a package of double-stuffed Oreos, a bag of slowly dissolving onions, and whatever else is in the pantry at the moment. So when Democrats cry about “market instability,” they’re not defending the working class. They’re defending fund managers, billionaires, hedge funders, donor classes, and Congressional stock speculators. In other words, their people.

💰 But consider this. Is the stock market adjustment a bug or a feature? Trump called it “medicine,” but what is he treating? He said the market medicine would treat “something,” like a vague placeholder standing in for a diagnosis he knows but won’t name. So let’s take a swing at filling in the blank.

Trump has already defanged the deep state by turning off its taxpayer cash-to-NGO spigot. So we know he’s laser-focused on stripping our enemies’ financial weapons. But what about the money they already stole? Money they can use to create mischief, fund paid protests and lawfare, and otherwise hogtie the agenda? The billions Biden pumped into their networks over the last four years?

That money isn’t sitting around in zero-interest checking accounts. They didn’t use it to buy Costco gold bars, either.

Those billions of hoovered-up taxpayer money that Biden lavished on leftwing NGOs is almost certainly invested in the stock market. Could this ‘adjustment’ —and let’s be honest, it’s a long overdue correction— be intentionally aimed at draining the progressive war chest and also pre-emptively popping the overpriced market bubble that Trump inherited?

In other words, the medicine will fix both the market Trump inherited and drain the progressive war chest that funds paid protests, lawfare, election subversion, and every alphabet NGO ending in “justice” or “equity.”

Since the Obama era, financial bigwigs like Warren Buffett have rung alarm bells about overheated stock prices. The problem was intensified by big bailouts and market manipulation (like SPACs) that added nothing to underlying values while the DJIA spiraled ever higher, ever closer to the Sun. The markets teetered on the high wire of unbelievably risky FAANG stocks, wherein seven tech companies hog the first third of the entire Dow Jones’s value.

Last year, Warren Buffett famously liquidated most of his portfolio into cash. Well before the election. No press conference. No panic. Just $334 billion dollars saying, We’re getting off this rickety roller coaster.

Trump’s enemies—media pundits, establishment economists, champagne-globalist think tankers— publicly and often hoped he’d walk right into a Wall Street trap: an overpriced, overstimulated market ripe for correction, just in time for him to own the crash. The Dow was frothy, valuations were stretched, and recession whispers were already in the air when he stepped back into office.

Could Trump at once be fixing the markets and also fixing the Democrats’ slush funds for good? Are those the things the medicine fixes? The timing fits. If medicine like this must be taken, then it’s best to choke it down early in the presidential term. We haven’t even hit 100 days yet.

You’d think at least one of the “experts” would remember the last sixteen years of warnings about the sky-high Dow. But don’t hold your breath waiting for fake news to explain it.

Luckily, we’ve got other ways to get the message out now.

Trump said, “Hang tough, it won’t be easy, but the end result will be historic.” And if he pulls this off — if he resets the stock market, starves the slush funds, and rebuilds the markets on the back of real, global trade deals instead of reckless financial gimmicks — then he won’t just make America great again.

He will make history. And I, for one, plan on enjoying every minute of it.

Have a magnificent Monday! Then head right back here tomorrow morning for another historic helping of C&C-style essential news and commentary.

Don’t race off! We cannot do it alone. Consider joining up with C&C to help move the nation’s needle and change minds. I could sure use your help getting the truth out and spreading optimism and hope, if you can: ☕ Learn How to Get Involved 🦠

How to Donate to Coffee & Covid

Twitter: jchilders98.

Truth Social: jchilders98.

MeWe: mewe.com/i/coffee_and_covid.

Telegram: t.me/coffeecovidnews

C&C Swag! www.shopcoffeeandcovid.com

Good morning Jeff and the C&C army! For regulars who don’t know me (hi! 👋), I co-authored The War on Ivermectin with the inimitable Dr. Pierre Kory, plus a stack of other books and a snarky Substack that refuses to behave.

This weekend I did what any completely normal person would do after several cups of coffee and passing one-too-many ignorant protestors on the roadside: I launched a Change.org petition urging RFK Jr. to immediately and permanently yank the COVID so-called-vaccines off the market and investigate every last criminal involved in their production, promotion, and peddling.

Please sign and share if you think zero liability and billions in profits are NOT the recipe for public health. :)

https://www.change.org/p/urge-robert-f-kennedy-jr-to-immediately-ban-covid-vaccines-and-investigate?

Sometimes you have to play net zero sum games in order to get the other party to capitulate. We win in the end because no other country can win a game that declares the winner as the one to lose the slowest.

Buckle-up, it'll be bumpy, but Main Street is far more important than Wall Street.

Thats what Trump is using tariffs for.

I wouldn't get too "worried" by what all these so-called experts and politicians are saying.

Afer all, they're the same people who want us to keep doing what got us $40 trillion in debt, and hollowed out our manufacturing base, while they fattened their wallets, all the while the American worker became more productive but got paid less.