☕️ BALLS OF STEEL ☙ Friday, April 21, 2023 ☙ C&C NEWS 🦠

FDA ends boosters and lowers doses; Feds jack rates on good-credit folks; Twitter de-badges Soros, others; SpaceX rocket make a sudden stop; ABC admits weather tinkering; and a UFO update.

Good morning, C&C, it’s Friday! Your roundup today includes: FDA didn’t just end boosters, it lowered the doses; Federal agencies increase mortgage fees for high-credit scorers; Twitter de-badges George Soros and other cheapskates; SpaceX rocket makes an abrupt, unscheduled stop in mid-flight; ABC accidentally admits weather modification; and the Pentagon claims advanced UFO technology is from foreign adversaries.

🗞💬 *WORLD NEWS AND COMMENTARY* 💬🗞

💉 Earlier this week I reported on the FDA’s new “simplified” vaccination schedules, which effectively ended boosters for most people, and put a clock on everybody else. Remember, it was the one that said unjabbed people only have to take one shot?

Well, the FDA has now published its clinical guidance, and not only did the FDA clamp down on future shots in general, it also quietly lowered the mRNA dosages in each shot, by as much as 75%.

For example, the prior dosing of Moderna’s original vaccine for unvaccinated adults was two doses of .5 ml with 100 ug per shot, for 200 ug’s of mRNA total over 4 weeks, to be considered “fully vaccinated.” Under the new guidance, fully vaccinated is just a single .5 ml dose with HALF the mRNA, 50 ug’s, for 50 ug total. That’s 25% of the prior dose.

So far, none of the FDA’s public or clinical guidance cites a single study justifying the changes, or even any data. Where did this sudden and unexpected change come from?

Well, I noticed one thing. The change came about two weeks following the end of the Covid State of Emergency. The end of the SOE put a political clock on how long they can continue EUA administration of the jabs. In fact, three days ago, around the same time as the dosing change, the FDA said, “The hope is to transition all these products into Licensed products.”

Hope!

Which means all the emergency-related special liability protections will be ending soon. Cui bono. The weird thing is, when you follow the Science, it always leads back to the accounting department.

And remember, the FDA has completely cut off people who’ve already had the bivalent booster:

Corporate media has been completely silent about the change, which also tells you a lot. Plus, I hope you will always remember that cockroach Fauci was constantly pushing boosters on us and promising terrific results:

But keep following the Science! It will get somewhere, someday. They promise.

🔥 A sensational story ran yesterday striking at the heart of the most successful marketing innovation in history: the credit score. Social media went wild yesterday after the New York Post ran this electrifying headline: “HowThe US Is Subsidizing High-Risk Homebuyers — at the Cost of Those With Good Credit.”

There is more — and less — to the story than the headline suggests.

Yesterday, mortgage giants Fannie Mae and Freddie Mac — both completely government-owned since the late-great real estate disaster of 2008 — updated its arcane, complicated schedule of fees called “Loan Level Price Adjustments.” The LLPA charts set small loan fee adjustments, which retail banks like Wells Fargo use when making government-backed FNMA and FHLMC loans.

Banks are not allowed to loan people the up-front costs. So instead of making loan buyers pay the fees up front, which everybody hates, banks can roll them into the loan by increasing the interest rate a small amount. This way, it is easier for banks to sell loans by lowering the up-front costs of the loan.

Therefore, when loan fees increase, it usually nudges interest rates up, too.

You with me so far? Okay, so the fee adjuster schedules also vary by borrower credit score, in order to reflect the differential risk posed by people who sign every free credit card application that comes in the mail, versus people who sign up to be immediately notified if their credit score ever slips a single point. And all of us have been trained from birth by Big Debt that a higher score will be magically rewarded in all kinds of ways, but especially by paying lower fees and rates on loans.

So that’s why the Post’s headline was a social media hand-grenade, especially among people who, like their parents taught them, groom their credit scores more carefully and beautifully than their lawns.

Here’s the relevant part of the new fee charts. It’s a boring list of numbers, so I’ve highlighted two parts that industry folks are complaining about:

The columns highlighted in yellow include loans with no fee adjustments at all. They are high-down payment loans, where the borrower is paying at 30%-40% down. Low-credit-score people pay the same as high-scorers. The sensible explanation is, since there’s plenty of equity in the home, there is little risk to the bank, and therefore no risk adjustment is needed.

The green highlights show the strangest effect of the new schedules. Someone with a perfect credit score (over 780) pays more fees (+0.375%) if they pay 20% down than does someone with the same credit score who pays only 5% down (+0.125%). That seems backwards, and is the exact opposite of the logic used for the yellow-highlighted region.

The explanation seems to be that mortgage insurance is required for loans paying 10%-down or less. So the banks are now charging more fees to people who pay more down and thereby avoid paying for mortgage interest. Since the bank doesn’t get mortgage interest on 80% loans, they are obviously be viewing those loans as having increased risk, which is highly suggestive: the government apparently thinks the real estate market could lose more than 20% value.

Thanks Joe Biden!

Now all of that was perfectly fascinating, I’m sure, but what about the Post’s headline? The one saying higher-credit score people will pay higher rates? It doesn’t show up in the numbers, not exactly. If you look back at the table, you’ll see that — apart from the high down-payment loans where everybody gets the same rates — low credit scorers always get the highest fee adjusters and high credit scorers always get the lowest fee adjusters.

You can see it, right there.

So what on Earth what is the Post talking about? It’s not wrong — the federal government did “rebalance” the fee adjusters, increasing high-credit score adjusters and lowering low-credit score adjusters. For example, a buyer with a horrible 620 credit score (paying only 5% down) gets a bump of only +1.75% under the new schedule – which is half the old adjuster of +3.50% for that bracket.

To make up for the lowering of the fee adjusters for the bottom end of the schedule, they tweaked up the top part, so high-scoring folks now pay more. Thank you and you’re welcome! In that sense, high-scoring folks are offseting the benefit for low-scoring folks, and in that sense, are being “punished” for having a high credit score.

But the low scorer still pays more. Just not as much more as before.

🔥 Whew! That took a lot of words! But I can’t leave the subject without pointing out there’s nothing new about the risk-shifting; WE’VE BEEN SUBSIDIZING LOW CREDIT BORROWERS SINCE THE CLINTON ADMINISTRATION. What do you think caused the real estate collapse? Who do you think paid — and continues paying — for everything that broke? What do you imagine a “sub-prime mortgage” is?

There are dozens if not hundreds of sweetly-named federal programs designed to vacuum taxpayers’ and reliable borrowers’ pockets, and then insert the lifted money into the pockets of deadbeats and shysters. Don’t even get me started.

It’s all the same acidic, collapse-creating risk-shifting policies supposedly intended to help low-credit people, who the government insultingly assumes are black, and it trickles down into every nook and cranny of the federal mortgage loan apparatus, like these fee adjuster schedules.

In other words, the story is really nothing new, except maybe that people noticed them doing it this time.

🔥 As it continues to erase the previous owners’ anti-egalitarian culture of virtue, Twitter removed George Soros’ free Twitter verification badge yesterday, since the billionaire is apparently too cheap to pay for it, which delighted many people. Also on the BlueBird’s chopping block yesterday were Bill Gates and Jack Dorsey.

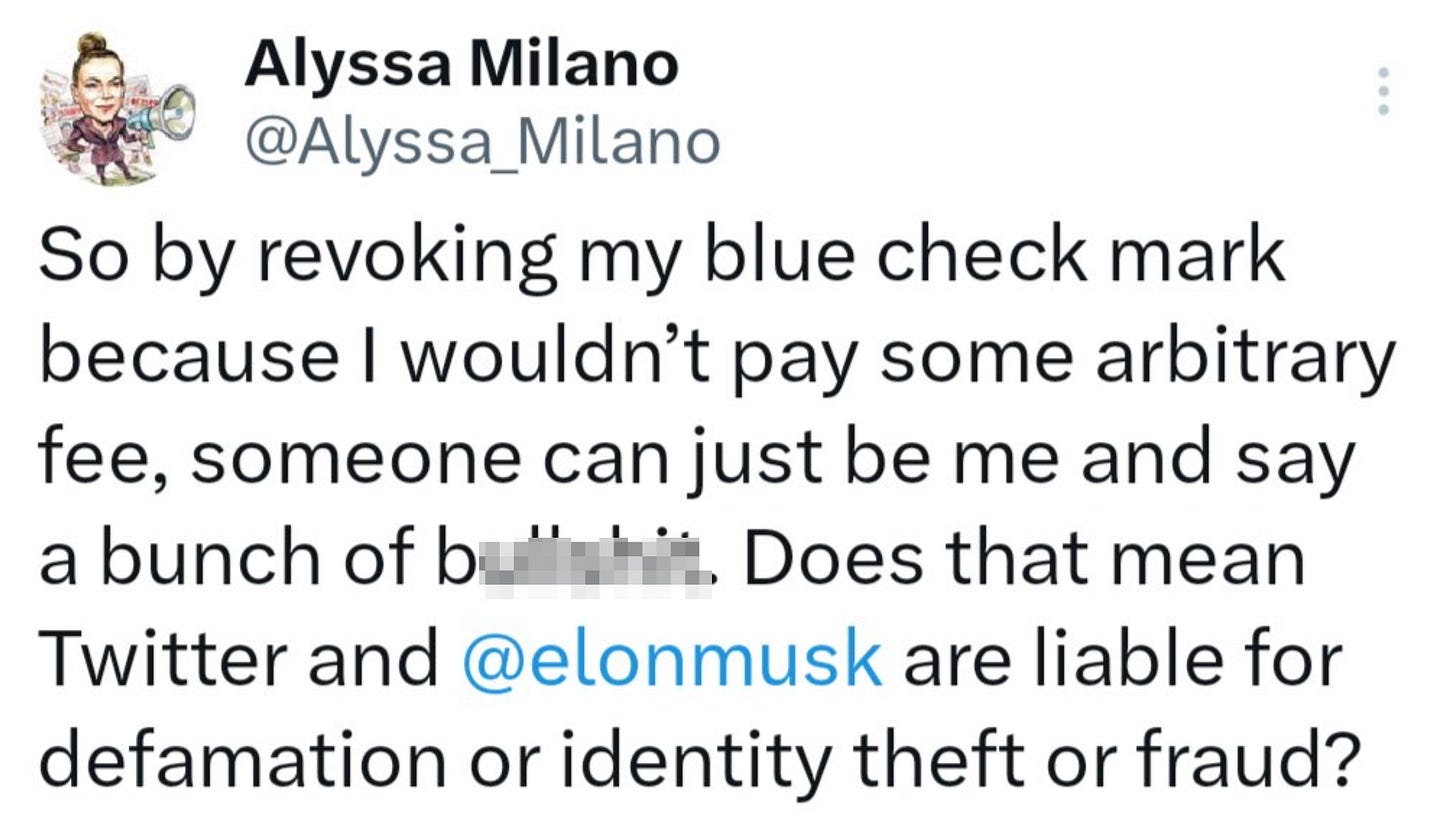

Oh, and Alyssa Milano:

Poor Alyssa. You feel sorry for her, right?

👨🚀 SpaceX’s largest unmanned rocket — the biggest in history — had a successful takeoff but then “experienced a rapid unscheduled disassembly” over the Gulf of Mexico.

In other words, it blew up. But not on the launch pad.

It exploded like a bottle rocket after setting several important records. SpaceX’s new rocket technology is aiming to lower payload cost-per-pound by an order of magnitude, from $1,000 dollars a pound to something closer to ten dollars a pound. When they get it done, and they will, it will revolutionize the private space industry.

So both SpaceX and NASA counted the explosive result as progress.

🔥 It must be getting really hard to hide. ABC News ran a story yesterday about widespread, government-funded weather modification projects. But the contrails are definitely just water vapor! Ignore ABC News and your own lying eyes.

That apparatus attached to the wing with all those chemical sticks is really just where the water vapor comes out. Each of them is a perfectly normal, water-vapor-stick. Because if the engines don’t produce enough water vapor to make a contrail, then they use these water sticks to make more water vapor, so that people won’t get all “conspiracy theory” and think the government is actually dumping chemicals into the atmosphere or something.

But wait, there’s more. It’s actually two conspiracy theories in one! The reporter also explained, “At the University of Colorado, researchers are working on artificial intelligence to deploy cloud-seeding drones.”

Haha, it’s LITERALLY Skynet!

Enjoy the Twenty-First century. Some people obviously need to go back and watch those Arnold Schwarzenegger movies from the 80’s again.

👽 Yesterday, Time Magazine ran a story headlined, “The U.S. Is Investigating Over 650 Possible UFOs.”

According to the story — most of which was a video report — Pentagon official Sean Kirkpatrick, director of the Defense Department’s All-Domain Anomaly Resolution Office (ADARO), appeared before a Senate Armed Services subcommittee Wednesday to announce its latest findings: the U.S. government is investigating over 650 reported UFO sightings.

In the clip, Kirkpatrick can be seen reviewing some of the cases and discussing whether or not they are truly unidentified. He said most cases — but not all — turn out to be Chinese war balloons and perfectly undisturbing stuff like that. Well, he didn’t say “Chinese.” I just assumed that.

One of the most mysterious objects was a floating metallic ball. Floating balls of steel! Watching the video, I thought one of the other “objects” looked a whole lot like the former Speaker of the House on a broomstick. Just saying.

Kirkpatrick also told Congress that none of the cases so far evidence any technology that violates the laws of physics or demonstrate any extraterrestrial activity. So.

However, Mr. Kirkpatrick also explained that he was “concerned” about a foreign connection (he called it a “nexus”) with the more advanced technical capabilities shown in some unexplained cases — and said the Pentagon DOES believe there are “indications of a foreign nexus,” even though he was reluctant to make any specific identifications at this point.

What do you think? Aliens or Chinese-commie floating balls?

Have a fabulous Friday, and we’ll meet back here tomorrow for the Weekend Edition.

Join C&C in moving the needle and changing minds. I could use your help getting the truth out and spreading optimism and hope, if you can: https://www.coffeeandcovid.com/p/-learn-how-to-get-involved-

Twitter: @jchilders98.

Truth Social: @jchilders98.

MeWe: mewe.com/i/coffee_and_covid.

Telegram: t.me/coffeecovidnews

C&C Swag! www.shopcoffeeandcovid.com

Emailed Daily Newsletter: https://www.coffeeandcovid.com

"...when you follow the Science, it always leads back to the accounting department."

Ah yes...finally getting near Big pHarma's bank account.

This is how we win!

Know therefore today, and take it to your heart, that the Lord, He is God in heaven above and on the earth below; there is no other.

— Deuteronomy 4:39 NASB1995